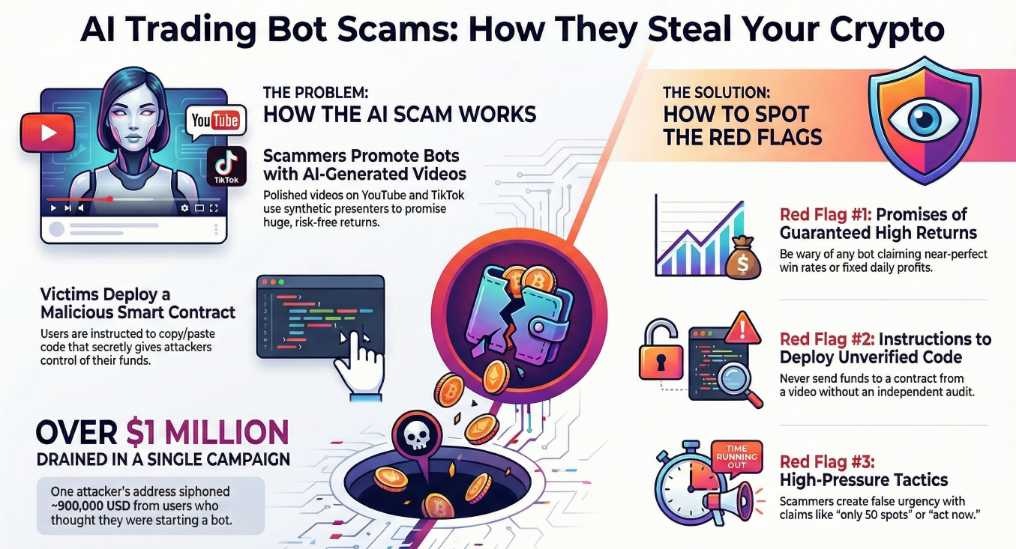

In mid‑2025, SentinelLabs and multiple crypto outlets documented a campaign where scammers used AI‑generated YouTube videos to promote malicious “free MEV trading bots.” The videos showed polished tutorials and synthetic presenters instructing viewers to copy a Solidity contract into Remix, deploy it, send ETH, then click a “Start” function to begin “risk‑free arbitrage.

Under the hood, the contract quietly added an attacker‑controlled wallet as co‑owner and routed all funds to that address using obfuscation tricks like XOR‑encoded data and huge decimal‑to‑hex conversions to hide the real destination. Researchers estimate that more than 1 million dollars in ETH was siphoned across many victims, with a single attacker address pulling in about 244.9 ETH—roughly 900,000 dollars at the time—from users who thought they were about to run a profitable MEV bot.

Why AI made these scams go viral in 2025

Security analysts warn that AI has made it dramatically easier to launch convincing, large‑scale crypto scams. Attackers now use AI tools to generate attractive presenters, realistic voiceovers, and “testimonial” clips at almost zero cost, then mass‑upload tutorials to aged YouTube accounts with manipulated comments and inflated view counts.

Regulators such as NASAA list AI‑themed crypto pitches and “AI trading bots” as top investor threats for 2025, noting that scammers exploit social platforms where short‑form videos on TikTok, Instagram Reels, and YouTube reach millions of retail traders. Surveys of state regulators show that a large share of likely frauds now originate on social apps, with many officials expecting a big rise in deepfake‑style investment scams that impersonate celebrities and “expert traders.”

Red flags: how to spot fake AI trading bots

Retail traders can avoid most of these schemes by assuming any black‑box bot with guaranteed returns is malicious until proven otherwise. Common warning signs include:

- Promises of near‑perfect win rates or fixed daily profits, especially when tied to AI buzzwords like “deep learning bot” or “secret institutional MEV AI.”

- Instructions from YouTube or Telegram to deploy unknown contracts and send funds without independent audits or readable, verified source code.

- Heavy pressure to act quickly—“only 50 spots,” “bot will be patched soon”—plus referral links and gated communities that discourage outside questioning.

- No registered company, no licensing, and no real‑world identity beyond social profiles and videos.n

Regulators and security experts repeatedly emphasize: if someone online offers a secret AI bot with guaranteed returns, the safest assumption is that they want your deposits, not your success.

Safer ways to use bots and automation

Algorithmic trading and automation are not inherently scams, but the due‑diligence bar needs to be much higher in 2025. Traders who still want to use bots should

- Stick to established platforms with clear teams, legal entities, and documented risk—not anonymous “devs” pushing scripts in DMs.

- Prefer open‑source strategies where code can be reviewed or at least verified on‑chain over opaque binaries or copy‑paste contracts from videos.

- Start with tiny capital allocations, assume any single bot can fail catastrophically, and never fund a bot with money that cannot be lost.

- Check regulator scam trackers and alerts before sending funds, especially when the pitch leans heavily on AI hype.

As AI tools keep improving, the gap between a real trading tutorial and a weaponized, synthetic scam video becomes harder to see at a glance, which is exactly why attackers are leaning into this model.