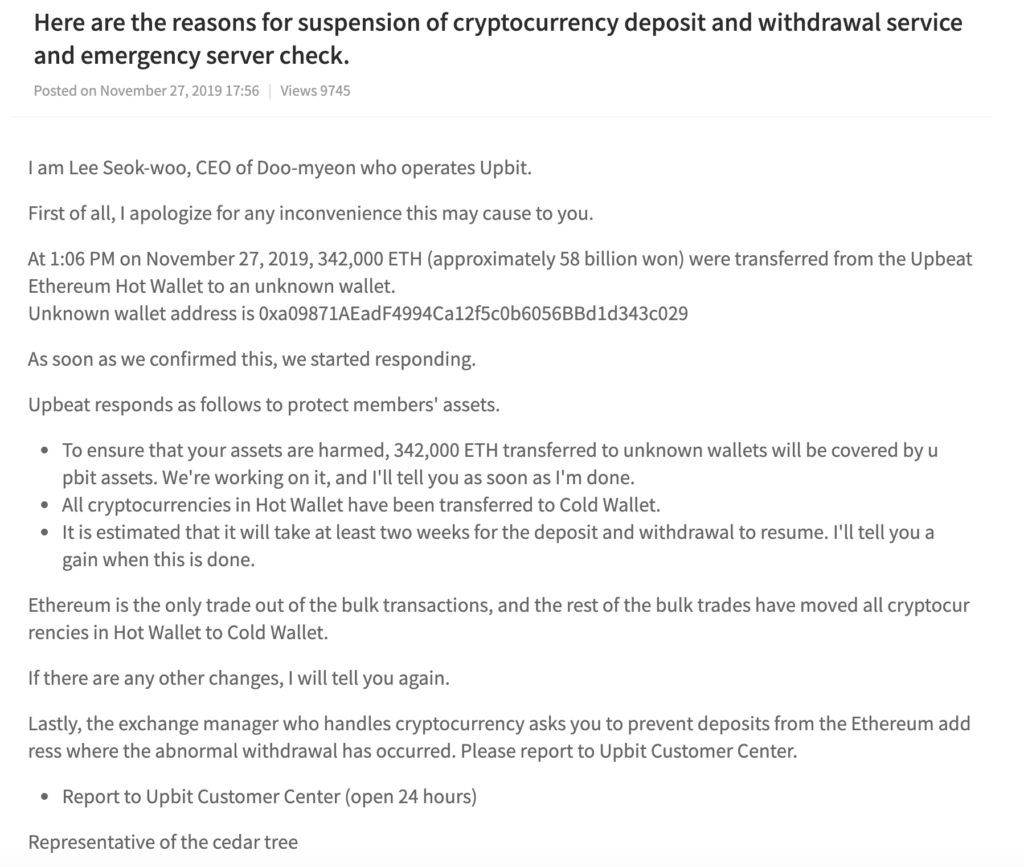

Multiple sources have claimed Upbit, the largest cryptocurrency exchange in South Korean, may have been hacked after 342,000 Ethereum ($50 Million) coins transferred out of the exchange’s wallets to unknown wallet. The exchange platform went into unscheduled maintenance right after the transfer.

Cryptocurrency monitoring service “Whale Alert” has recorded the following transaction:

? ? ? ? 342,000 #ETH (49,848,273 USD) transferred from #Upbit to unknown wallet

Tx: https://t.co/HairAS3gee— Whale Alert (@whale_alert) November 27, 2019

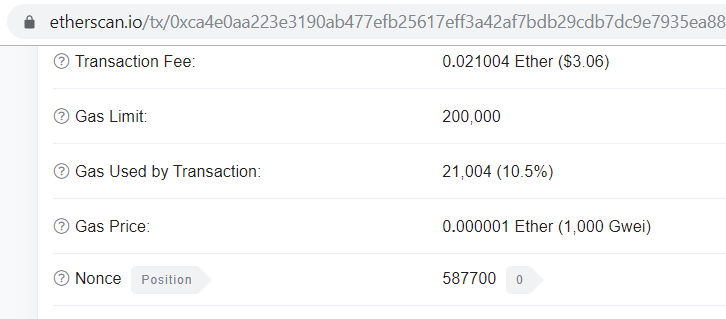

The above ETH transaction might indeed be a hack: the TX was sent with a gas fee of 1000 gwei (100x the price for a “fast” transaction). This person wanted to be 1000% sure the TX goes through ASAP. No exchange ever sends a TX with this fee.

The exchange have posted the bellow notice on its website:

This is a developing story, we will keep you updated about this alleged security breach.