Exchanges

Bitfinex’s CTO: Bitfinex has raised $1 billion through LEO token in a private sale

Bitfinex’s CTO: Bitfinex has raised $1 billion through LEO token in a private sale

Paolo Ardoino, Bitfinex’s chief technology officer tweeted on Monday that Bitfinex has achieved the target in just 10 days, with participation from “giant” firms from both within the cryptocurrency industry and outside. The funds were collected in the form of USDT, the stablecoin operated by the closely-linked firm Tether, according to the tweet.

. @bitfinex is able to raise 1b USDt in 10 days, in a private sale. Private companies, giants in our industry and outside, made investments for > 100m each. A legion of inside and outside users made investments for > 1m each.

— Paolo Ardoino (@paoloardoino) May 13, 2019

He further adds:

Why? Because they know we are trustworthy, they recognize what we have been doing (without needing us bragging about it publicly) and they want us keep fighting for the industry whole. Their own words. Thank you everyone for the amazing support we got. We are impressed.

Bitfinex will be aunching a dedicated exchange platform for projects to raise funds via similar initial exchange offerings (IEO) next month.

Exchanges

Binance Delists Four Major Cryptocurrencies: What You Need to Know

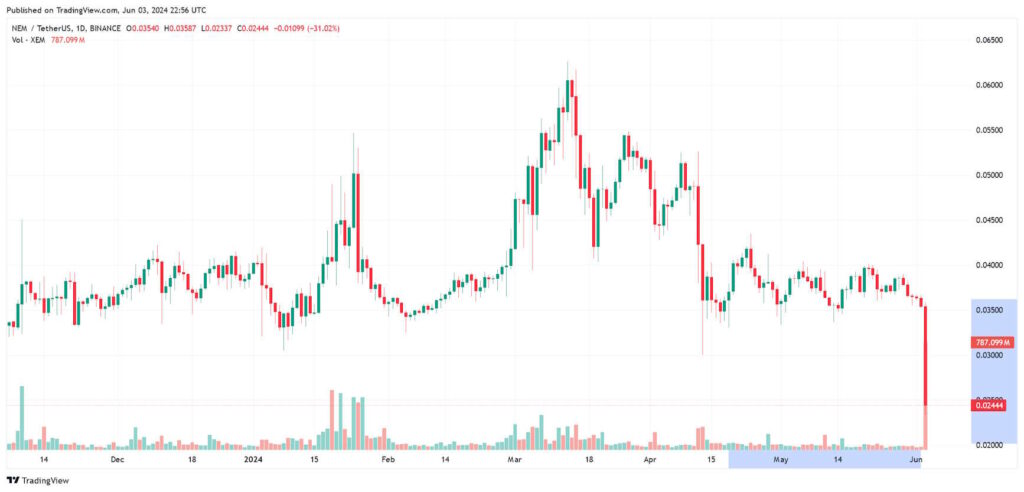

Binance, the world’s largest cryptocurrency exchange has announced its plans to delist and pause trading activities for the OMG (OmiseGO), WAVES, WNXM (Wrapped NXM), and XEM (NEM) cryptocurrencies on its platform effective June 17, 2024.

According to the announcement, the desisting comes after Binance’s periodic review determined these digital assets no longer meet the exchange’s standards and requirements. Factors like the project team’s commitment, development activity, trading volume and liquidity, network stability and security, public communication, and regulatory compliance all play a role in such decisions.

“Our priority is to ensure the best services and protections for our users while continuing to adapt to evolving market dynamics,” Binance stated in the announcement. “When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it.”

Binance’s announcement to delist these cryptocurrencies had an immediate impact on their market prices. Several of the affected digital assets, such as OMG and WAVES, experienced double-digit percentage drops following the news. However, XEM took the hardest hit, plummeting by over 44% within a 24-hour period. At the time of writing, XEM is trading at approximately $0.024 according to CoinMarketCap‘s data, marking a seven-month low for the embattled cryptocurrency.

Each coin had its own unique journey and story behind the chapters that led to this outcome. Let’s have a look at the rise and fall of these digital assets:

Contents

OmiseGO (OMG)

OmiseGO reached an all-time high of around $28 in January 2018 amid the bull market and hype around its Plasma scaling solution for Ethereum. Founded by Jun Hasegawa and the Omise team, OMG aimed to enable secure, low-cost peer-to-peer transactions and decentralized exchange. OMG could mot compete against strong competitors like Ethereum

WAVES

This cryptocurrency for the Waves blockchain platform hit an all-time high price of around $33 in December 2017. Founded by Alexander Ivanov and Sasha Ivanov, Waves allows for the issuance, transfer and trading of digital assets/tokens. Its technology enables decentralized crowdfunding, DEXs, and DAOs. Yet despite launching numerous products and services, Waves failed to gain as much traction as competitors like Ethereum and BNB. At the time of writing, WAVES is trading at $1.60.

Wrapped NXM (WNXM)

Wrapped NXM is an ERC-20 token that represents the value of and provides access to the NXM altcoin for the NXM Privacy Network. NXM itself peaked around $245 in December 2017 and was founded by the pseudonymous “roman Protocols.” Its blockchain aimed to support confidential transactions and DeFi through advanced cryptography. However, the project saw little mainstream adoption. At the time of writing, NXM is being traded at $79.39.

NEM (XEM)

The OG crypto NEM reached an all-time high price around $2 in early 2018 before declining. Launched in 2015 by the non-profit NEM Foundation, it was created to build a new economic system through a customized version of blockchain technology called Proof-of-Importance. NEM (XEM) is one of the earlier blockchain projects that introduced unique features and an interesting wallet but struggled to keep up with industry developments due to the lack of project funding.

What does delisting mean for users?

For users, delisting means that they will no longer be able to trade these coins on the Binance platform. The exact trading pairs being removed are:

- OMG/USDT

- WAVES/BTC

- WAVES/ETH

- WAVES/TRY

- WAVES/USDT

- WNXM/USDT

- XEM/USDT

All trade orders will be automatically removed after trading ceases in each respective trading pair. Users are advised to check their accounts regularly to ensure they have not selected “Hide Small Balances” in all of their wallets.

What happens to my assets?

According to Binance, Deposits of these tokens after June 18th, 2024, will not be credited to your account. Withdrawals of these tokens from Binance will not be supported after September 17th, 2024. Delisted tokens may be converted into stablecoins on behalf of users after September 18th, 2024. Please note that the conversion of delisted tokens into stablecoins is not guaranteed.

What about Binance services?

Binance will delist the tokens mentioned above from various services, including:

- Binance Simple Earn: Users may choose to redeem their Flexible and Locked Products positions beforehand. Otherwise, these positions will be automatically redeemed at the above-mentioned time and subsequently transferred to users’ Spot Wallets.

- Binance Auto-Invest: Users may choose to remove the plan(s) beforehand. Otherwise, the next recurring cycle of the aforementioned token(s) will fail.

- Binance Loans (Flexible and Stable Rates): Users are strongly advised to repay their outstanding loans before June 11th, 2024, to avoid any potential losses.

- Binance Futures: The USDⓈ-M WAVESUSDT perpetual contract will be delisted after settlement is complete. Users are advised to close any open positions prior to the delisting time to avoid automatic settlement.

- Binance Margin: Users are strongly advised to close their positions and/or transfer their assets from Margin Wallets to Spot Wallets prior to the cessation of margin trading.

Exchanges

LocalMonero Announces 6-Month Shutdown Plan

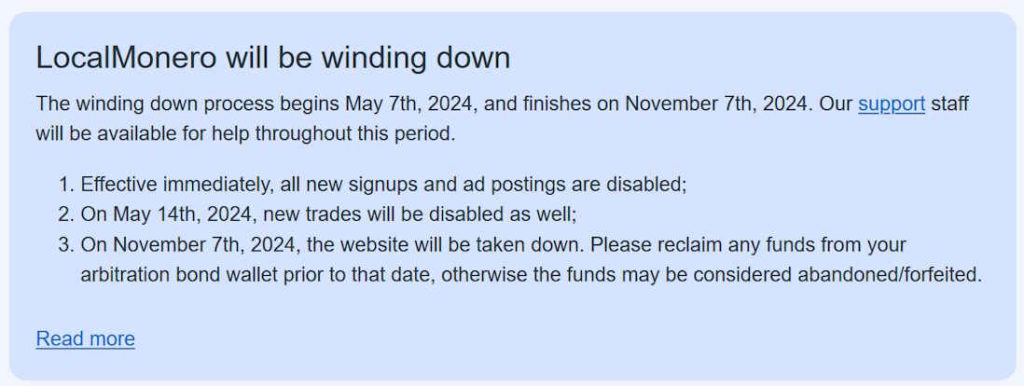

LocalMonero, the peer-to-peer exchange platform for the privacy-focused cryptocurrency Monero (XMR), will be shutting down it’s services after nearly seven years of operation.

As per LocalMonero’s announcement, the crypto exchange will be winding down operations over the next 6 months before permanently closing on November 7, 2024. The team expressed gratitude for the community’s support over the years and assured users that support staff would remain available throughout the transition period.

LocalMonero was one of the earliest platforms dedicated to Monero, the leading privacy cryptocurrency that obfuscates transaction details to protect user anonymity. The exchange allowed buyers and sellers to meet and trade Monero directly through an escrow system. Users could trade their XMR without the need for centralized exchanges. The service prided itself on its commitment to privacy, a core tenet of the Monero community.

Despite LocalMonero’s closure, the team expressed optimism about Monero’s future, stating “with the imminent launch of Haveno and other DEXs like Serai, atomic swaps, the coming addition of FCMP…as well as the continuing and rapidly accelerating development of the Monero protocol, we’re confident that Monero’s future is bright.”

FCMP, or Full Compact Merkle Path, is an upcoming upgrade that will increase Monero’s default anonymity set to include the entire blockchain, replacing the current “ring” signatures of 16 decoys.

For longtime LocalMonero users, the exchange has outlined clear steps for finalizing trades and recovering funds before the November 7th shutdown date. New signups and trade postings have already been disabled, with new trades being blocked after May 14th.

Bitcoin

No Evidence of Hack, Says Bitfinex CTO Amid Ransomware Gang’s Allegations

In the world of cybersecurity, claims of data breaches can cause significant concern and speculation. Recently, a ransomware group named FSOCIETY claimed to have successfully hacked several organizations, including the cryptocurrency exchange Bitfinex. However, Bitfinex’s Chief Technology Officer (CTO), Paolo Ardoino, has dismissed these rumors, stating that a thorough analysis of their systems revealed no evidence of a breach.

According to Ardoino, who is also the CEO of Tether, less than 25% of the email addresses allegedly stolen from Bitfinex’s servers match legitimate users. This casts doubt on the validity of FSOCIETY’s claims regarding the supposed hack.

The ransomware group, styled after the fictional hacking group from the TV show “Mr. Robot,” claimed to have breached several victims, including Rutgers University, consulting firm SBC Global, and a cryptocurrency exchange they referred to as “Coinmoma,” which is likely a misspelling of Coinmama.

Ardoino expressed skepticism about the group’s claims, stating that if they had indeed hacked Bitfinex, they would have demanded a ransom through the exchange’s bug bounty program, customer support channels, emails, or social media accounts. However, Bitfinex received no such requests from FSOCIETY.

Furthermore, Ardoino shared a message from a security researcher suggesting that the real motivation behind the alleged hacks might be to promote FSOCIETY’s ransomware tools, which they reportedly sell access to in exchange for a subscription fee and a commission on stolen profits. Ardoino questioned the group’s need to sell their tools for $299 if they had truly hacked a major exchange like Bitfinex.

It’s worth noting that Bitfinex has previously fallen victim to a significant hack in 2016, resulting in the theft of a substantial amount of Bitcoin. Two individuals, including crypto rapper ‘Razzlekhan,’ pleaded guilty to money laundering charges in connection with that incident.

While the claims made by FSOCIETY have yet to be verified by the alleged victims, Bitfinex’s CTO remains firm in his stance that no breach has occurred. As cybersecurity threats continue to evolve, it is crucial for organizations to remain vigilant and take proactive measures to protect their systems and users’ data.

-

Altcoins5 years ago

Altcoins5 years agoProject Review: Pi Network, a New Scam Project in Town

-

Bitcoin4 years ago

Bitcoin4 years agoBitcoin Worth $1.2M Seized From Arrested Indian Hacker

-

Altcoins6 years ago

Altcoins6 years agoReview: Play Arcade Games Inside ARK Wallet And Win Some Free Cryptocurrency

-

Blockchain6 years ago

Blockchain6 years agoA Full Review: Utopia A New Decentralized P2P Blockchain

-

Bitcoin6 years ago

Bitcoin6 years agoAnother Exit Scam: NovaChain Shuts Down

-

Exchanges6 years ago

Exchanges6 years agoCrex24 Will Require KYC Verification

-

Bitcoin6 years ago

Bitcoin6 years agoJohn McAfee Has Gone Missing

-

Blockchain6 years ago

Blockchain6 years agoProject Review: Dmail Decentralized Blockchain Email