Non-fungible tokens (NFTs) have gained immense popularity on blockchains like Ethereum, Solana, and BNB Smart Chain. However, the Ordinals project aims to extend the concept of NFTs to the Bitcoin blockchain. While Bitcoin’s decentralized nature and security have historically made it difficult to implement changes to its code, the Ordinals team believes that Bitcoin NFTs have a place in the future of Web3. In this article, we will delve into the concept of Bitcoin Ordinals and explore its potential impact.

Understanding Bitcoin Ordinals

The Ordinals protocol introduces a system for numbering satoshis, the smallest unit of Bitcoin, and tracking them across transactions. By attaching extra data to each satoshi through a process called “inscription,” Ordinals enables the uniqueness of individual satoshis. This means that each satoshi can be treated as a distinct digital asset, similar to an NFT.

Unlike traditional NFTs, which rely on smart contracts and may have the assets they represent hosted elsewhere, Ordinals inscriptions are directly embedded onto individual satoshis within the Bitcoin blockchain. This approach ensures that Ordinals reside fully on the Bitcoin blockchain itself, inheriting its simplicity, immutability, security, and durability.

Ordinal Theory and Inscriptions

Ordinal Theory, in the context of Bitcoin, refers to the proposed methodology for identifying and tracking each satoshi throughout its lifecycle. This theory enables the inscription of digital assets, similar to NFTs, on individual satoshis within the Bitcoin network. The Taproot upgrade, implemented on November 14, 2021, made it possible to create ordinal inscriptions without the need for a separate sidechain or token.

Ordinal inscriptions come with a ranking system based on the rarity of satoshis. These rankings include:

- Common: Any satoshi other than the first satoshi of its block (2.1 quadrillion total supply).

- Uncommon: The first satoshi of each block (6,929,999 total supply).

- Rare: The first satoshi of each difficulty adjustment period (3437 total supply).

- Epic: The first satoshi after each halving (32 total supply).

- Legendary: The first satoshi of each cycle* (5 total supply).

- Mythic: The first satoshi of the genesis block (1 total supply).

Pros and Cons of Ordinals:

Ordinals bring forth new possibilities for the Bitcoin network beyond simple value transfers. However, this protocol has sparked controversy within the Bitcoin community. Some argue that Bitcoin’s simplicity should be preserved, focusing solely on storing and transferring value. Others believe that Bitcoin should evolve to include new features and use cases, with Ordinals being one such innovation.

One concern raised by the introduction of inscribed satoshis is the competition for block space, which can increase network fees. While some view this as a positive incentive for miners to secure the blockchain, others express reservations. As block rewards diminish over time, network fees will become the primary incentive for miners. The Bitcoin community remains divided on the implications of Ordinals, but the project undeniably brings innovation to the Bitcoin space.

Wallets for Bitcoin Ordinals

Previously, there was a lack of designated wallet interfaces for storing and transferring Bitcoin Ordinals Inscriptions. However, the situation has begun to change with the introduction of three wallets that now support Bitcoin Ordinals functionality: Ordinals Wallet, Xverse, and Hiro Wallet.

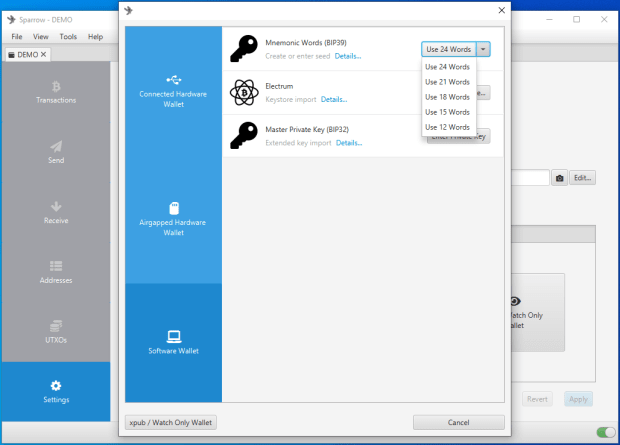

While the current functionality of these wallets may be limited, their developers have indicated that more features are on the way. These wallets serve as convenient options for users who prefer not to go through the process of setting up a separate Bitcoin wallet. Alternatively, if you seek more customization options, you can set up a Bitcoin wallet like Sparrow, which allows for Ordinal inscriptions.

To make compatible with Ordinals, check this detailed tutorial that provides step-by-step instructions. It’s important to note that this wallet is specifically for receiving Ordinals, and you should avoid sending BTC from this wallet to prevent accidental loss of both BTC and Ordinals.

Exploring Ordinals Marketplaces

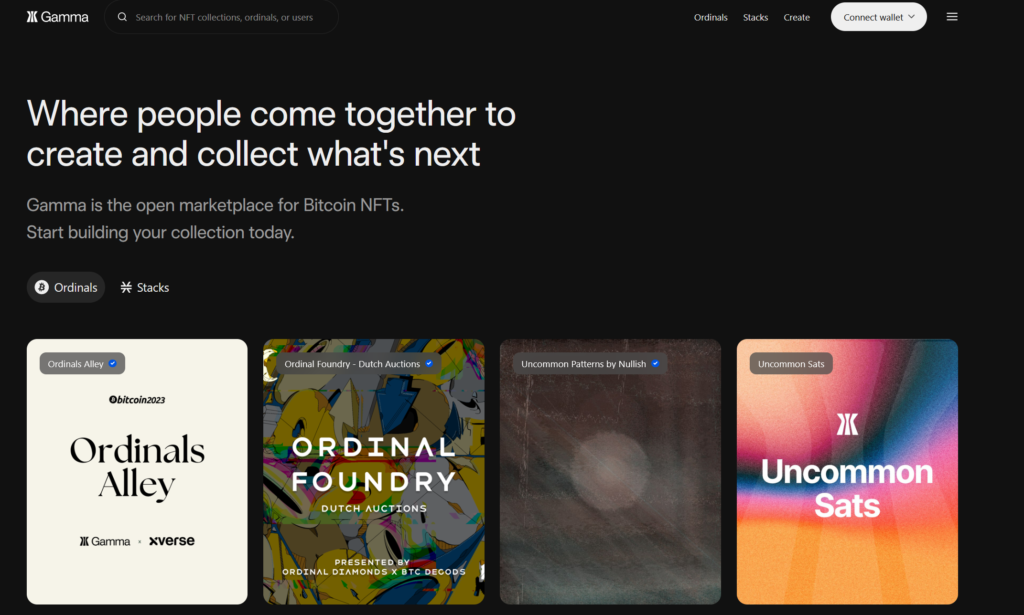

With the rise of Bitcoin Ordinals, dedicated marketplaces have emerged to facilitate the buying, trading, and creation of Ordinals. One such marketplace is Gamma, which has introduced a trustless Bitcoin Ordinals marketplace. Gamma aims to provide a remarkable Web3-native experience by combining an open marketplace, creator tools, and integrations with secure third-party wallet extensions. On Gamma, users can not only engage in buying and trading Ordinals but also create their own inscriptions.

Another noteworthy marketplace is Magic Eden, which has recently launched its Bitcoin NFT Marketplace. This platform offers a space for users to discover, buy, and sell Bitcoin Ordinals and other NFTs. Magic Eden provides a user-friendly interface and a seamless trading experience, attracting enthusiasts looking to engage with the growing Ordinals ecosystem.

Final Thoughts

As the popularity of Bitcoin Ordinals continues to surge, wallets and marketplaces are stepping up to cater to the demand for storing, trading, and creating Ordinals. Wallets like Ordinals Wallet, Xverse, Hiro Wallet, and customizable options like Sparrow offer users convenient solutions for managing their Ordinals. Meanwhile, marketplaces such as Gamma and Magic Eden provide platforms for buying, selling, and exploring the vibrant world of Bitcoin Ordinals and NFTs. With further developments on the horizon, the Bitcoin Ordinals ecosystem is poised to expand, offering exciting opportunities for users in the evolving Web3 landscape.