Lately, we have been receiving a lot of spamming referral links to join a new cryptocurrency project called “Pi Network”. I have decided to give it a try and to check their official website and to install Pi Network App on an Android Emulator to test it out.

According to Pi Network official statement: Pi is a new digital currency. This app allows you to access and grow your Pi holdings and serves as wallet to host your digital assets. Pi is fairly distributed, eco-friendly and consumes minimal battery power.

At the time of writing, Pi Network has over 3.5+ million engaged pioneers (Mobile App miners), 28.5K followers on Twitter, 97K likes on Facebook and 128K followers on Instagram.

Pi Network’s website is suspicious

On first impression, PI network’s website looks poorly designed and contains some inaccurate technical information. They claim that PI network is “The First Digital Currency You Can Mine On Your Phone“, and that is not true. Some older legit crypto projects such as uPlexa (UPX) and Electroneum (ETN) are using Mobile Apps to mine crypto coins.

When you’re looking into digital cryptocurrency companies and startups, experts recommend that you confirm that they’re blockchain-powered, which means they track detailed transaction data. in our case Pi Networks’ website dose not contain a working Blockchain explorer link, no project announcements, no technical white paper and no links to a github page.

Statements like “Better than Bitcoin” and “The real Bitcoin” has been proven over and over again to be a classic scam and its sad that people still fall for it.

Pi Network’s mobile App is also suspicious!

Pi Network’s App on Google play has a lot of fake reviews and all written written by users who only does it to spam their referral links. Yet, the app is rated 4.9 stars and has more than one million active installs and over 43k reviews!.

The App requires so many permissions

unlike any other crypto apps, the Android version of Pi Network app requires so many permissions. Installing Pi Network App on your phone will allow the app to access:

Device ID & call information:

read phone status and identity.

Storage & Photos/Media/Files:

read the contents of your USB storage

modify or delete the contents of your USB storage

Phone:

read phone status and identity.

Contacts:

read your contacts

Wi-Fi connection information:

view Wi-Fi connections

Other:

receive data from Internet

run at startup

full network access

prevent device from sleeping

draw over other apps

view network connections

control vibration

Draw over other apps is incredibly dangerous, the app can easily steal passwords. It can present messages as if they’re from other apps or read those messages.

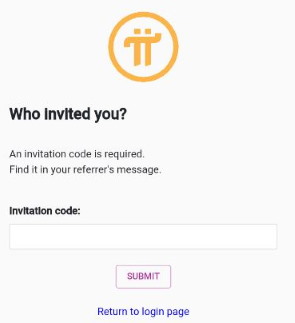

Invitation code is required in order to start using Pi Network App

Once you install the app, you will not be able to use it without a valid invitation code. This is a live example of pyramid schemes and click baiting scam projects which are “viral social applications” that lure people with the promise of profit by recruiting more members so they can increase their mining power.

When you start the app, you will be “mining” at the rate of 0.25 Pi per hour. You will need invite a lot of your friends to increase your mining power/hashrate. The more people sign up using your affiliate code the more mining power you will get.

You need to activate the miner (app) every 24 hours. Pretty unproductive and inconvenient I would say, though you get a notification reminder to turn the miner on.

After testing it for 24 hours, i can say The Pi Network app is not a real crypto miner. Its just an airdrop app that gives you a tiny piece of a massive, but unknown amount Pi per-mined coins.

Pi Network App security issues

PI Network app is sending network packets to a third party domains “socialchain.app” and “rayjump.com”, which is a weird behavior.

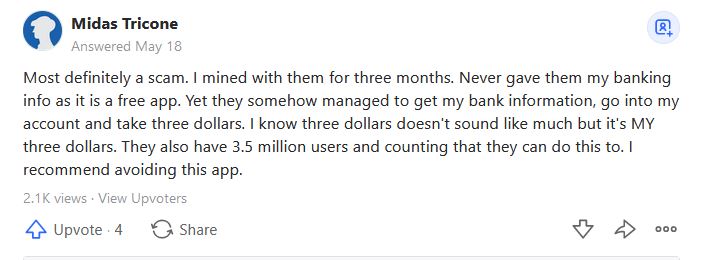

Quora user claims losing funds after using the App

Midas Tricone has claimed on a Quora post that he lost some funds from his banking account after installing and using Pi Network App

My final conclusion about PI Network

Pi Network is pyramid scheme scam project and has nothing to do with crypto mining. You must avoid it.