Bitcoin

The Environmental Impact of Cryptocurrencies: Balancing Innovation and Sustainability

Concerns about the environmental impact of cryptocurrency transactions are increasingly coming to the forefront. This article explores the potential ecological consequences of virtual currencies and raises the question of whether they can be sustainable in the long run. Let’s delve into the world of cryptocurrency and its environmental implications.

Contents

Understanding Cryptocurrency:

Cryptocurrencies, such as Bitcoin and Ethereum, utilize advanced cryptography to enable secure financial transactions. Unlike traditional currencies, these digital assets operate in a decentralized manner, without the need for a central bank or clearing house. Transactions occur directly between digital wallets and are recorded on a public ledger known as the blockchain.

The Creation of Cryptocurrency:

Cryptocurrencies like Bitcoin are created through a process called “mining.” Miners use specialized computers to solve complex mathematical puzzles in order to obtain new coins. The first miner to successfully find a specific number is rewarded with the cryptocurrency. The value of a cryptocurrency is determined by its agreed-upon worth within the user community.

Benefits of Cryptocurrency:

Cryptocurrency offers several advantages, including privacy, security, and decentralization. It allows for peer-to-peer transfers, bypassing the need for traditional financial intermediaries. User data is stored securely in personal wallets and can only be accessed with a private key. Additionally, cryptocurrencies often have a capped supply, which can protect against inflation.

Considerations for Sustainability:

While cryptocurrencies offer many benefits, their environmental impact is a cause for concern. The process of mining, which validates and creates new coins, consumes a significant amount of energy. The energy consumption associated with Bitcoin mining alone is comparable to the entire country of Sweden. A single Bitcoin transaction can consume a substantial amount of energy, contributing to carbon emissions and electronic waste.

Addressing the Environmental Impact:

To mitigate the ecological consequences of cryptocurrencies, several measures can be taken. First, transitioning to renewable energy sources for mining operations would significantly reduce the carbon footprint. Implementing carbon offsetting measures can provide immediate relief by balancing emissions. Furthermore, adopting more energy-efficient consensus mechanisms, such as Ethereum’s transition to proof-of-stake, can drastically reduce power requirements.

The Path to Sustainable Virtual Transactions:

As we move toward a cashless society, it is crucial to prioritize sustainability in the development and operation of cryptocurrencies. Investing in renewable energy infrastructure for mining operations, replicating the success of Ethereum’s proof-of-stake model, and promoting responsible e-waste management are essential steps in making virtual currencies environmentally friendly.

Final Thoughts

The energy-intensive nature of cryptocurrency mining raises concerns about its environmental impact. Achieving sustainability in the world of virtual currencies requires a collective effort to transition to renewable energy sources, improve consensus mechanisms, and minimize electronic waste. By prioritizing ecological responsibility, we can ensure that the future of virtual transactions aligns with our goals for a greener planet.

Bitcoin

Telecom Giant Vodafone Bringing Crypto to the Masses Via SIM Cards

The major telecom company Vodafone has unveiled an ambitious plan to integrate cryptocurrency wallets directly into the SIM cards used by mobile phones on its network. This cutting-edge move aims to make blockchain technology and crypto easily accessible to millions of smartphone users worldwide.

What’s Happening?

Vodafone, one of the largest mobile operators based in the UK, intends to combine crypto wallets with the subscriber identity module (SIM) cards inside phones. SIM cards are little chips that allow mobile devices to connect to a carrier’s network.

By embedding a crypto wallet into these ubiquitous SIM cards, Vodafone wants to introduce blockchain and virtual currency technology to the masses through the smartphones we all use daily.

The Bigger Blockchain Picture

This crypto SIM integration is part of Vodafone’s bigger blockchain strategy. The company has developed its own “PairPoint Digital Asset Broker” platform to enable secure digital identities and transactions across different blockchains.

Vodafone’s blockchain lead David Palmer emphasized in an interview that mobile phones are the main way billions access digital services and commerce. So partnering blockchain with SIM card tech is crucial for widespread adoption.

By 2023, there will be over 8 billion mobile phones in use globally. And estimates suggest crypto wallets on smartphones could reach 5.6 billion by 2030 as digital money goes mainstream.

Financial Restructuring

The crypto wallet announcement comes as Vodafone seeks to restructure its finances and raise billions in new funds through debt offerings and loans over the next couple years.

The company plans to take on $2.9 billion in total debt, including $1.8 billion in direct loans. Some of this financial overhaul relates to issues at Vodafone’s Indian subsidiary Vodafone Idea Ltd.

While navigating these monetary hurdles, Vodafone still sees major opportunities in emerging technologies like blockchain and aims to be an innovator helping drive mainstream crypto adoption through the SIM card strategy.

Bitcoin

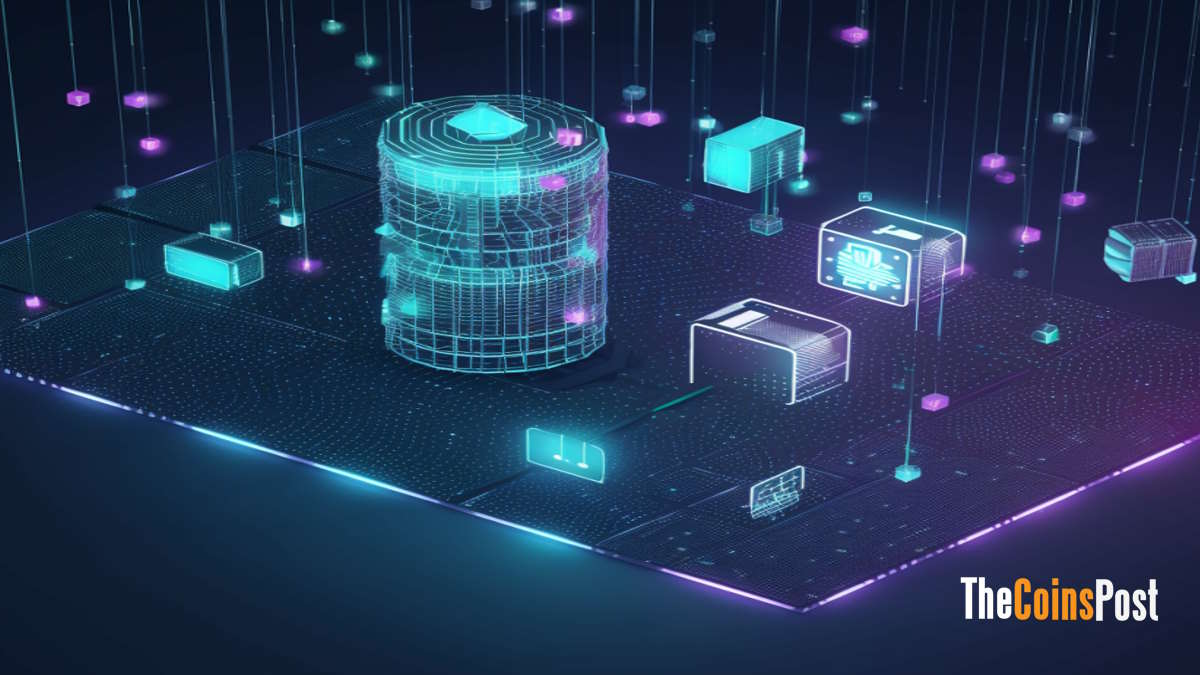

No Evidence of Hack, Says Bitfinex CTO Amid Ransomware Gang’s Allegations

In the world of cybersecurity, claims of data breaches can cause significant concern and speculation. Recently, a ransomware group named FSOCIETY claimed to have successfully hacked several organizations, including the cryptocurrency exchange Bitfinex. However, Bitfinex’s Chief Technology Officer (CTO), Paolo Ardoino, has dismissed these rumors, stating that a thorough analysis of their systems revealed no evidence of a breach.

According to Ardoino, who is also the CEO of Tether, less than 25% of the email addresses allegedly stolen from Bitfinex’s servers match legitimate users. This casts doubt on the validity of FSOCIETY’s claims regarding the supposed hack.

The ransomware group, styled after the fictional hacking group from the TV show “Mr. Robot,” claimed to have breached several victims, including Rutgers University, consulting firm SBC Global, and a cryptocurrency exchange they referred to as “Coinmoma,” which is likely a misspelling of Coinmama.

Ardoino expressed skepticism about the group’s claims, stating that if they had indeed hacked Bitfinex, they would have demanded a ransom through the exchange’s bug bounty program, customer support channels, emails, or social media accounts. However, Bitfinex received no such requests from FSOCIETY.

Furthermore, Ardoino shared a message from a security researcher suggesting that the real motivation behind the alleged hacks might be to promote FSOCIETY’s ransomware tools, which they reportedly sell access to in exchange for a subscription fee and a commission on stolen profits. Ardoino questioned the group’s need to sell their tools for $299 if they had truly hacked a major exchange like Bitfinex.

It’s worth noting that Bitfinex has previously fallen victim to a significant hack in 2016, resulting in the theft of a substantial amount of Bitcoin. Two individuals, including crypto rapper ‘Razzlekhan,’ pleaded guilty to money laundering charges in connection with that incident.

While the claims made by FSOCIETY have yet to be verified by the alleged victims, Bitfinex’s CTO remains firm in his stance that no breach has occurred. As cybersecurity threats continue to evolve, it is crucial for organizations to remain vigilant and take proactive measures to protect their systems and users’ data.

Bitcoin

Indian Police Seize 268 Bitcoins Worth $17 Million in Crypto Bust

Indian authorities have seized a large sum of bitcoins from a resident of Haldwani, a city in the northern Indian state of Uttarakhand. The seized cryptocurrency stash of 268 bitcoins is worth around $17 million at current prices.

The Enforcement Directorate (ED), a law enforcement agency that investigates financial crimes, carried out the bitcoin seizure. They arrested Parvinder Singh from his home in Haldwani after a raid prompted by information from US authorities.

Singh is allegedly part of an international drug trafficking syndicate called “The Singh Organization.” The criminal group used dark web marketplaces like Silk Road to sell drugs in the US, UK and other European countries.

To hide their illegal activities, the syndicate laundered the drùg money by converting it into bitcoins and other cryptocurrencies. ED officials said Singh and his associates received around 8,488 bitcoins over the years from their drùg sales on the dark web.

The bitcoin seizure was a rare collaboration between Indian and US law enforcement agencies. American officials have been investigating Singh and his accomplice Banmeet Singh for their roles in the international drùg cartel.

Cryptocurrencies like bitcoin are popular among criminals due to the anonymity they provide. However, this case shows authorities are getting better at tracing illegal crypto transactions and bringing the perpetrators to justice.

The investigation is still ongoing, and more arrests and seizures are expected as officials unravel the entire money laundering operation of The Singh Organization.

-

Altcoins4 years ago

Altcoins4 years agoProject Review: Pi Network, a New Scam Project in Town

-

Bitcoin4 years ago

Bitcoin4 years agoBitcoin Worth $1.2M Seized From Arrested Indian Hacker

-

Altcoins5 years ago

Altcoins5 years agoReview: Play Arcade Games Inside ARK Wallet And Win Some Free Cryptocurrency

-

Blockchain5 years ago

Blockchain5 years agoA Full Review: Utopia A New Decentralized P2P Blockchain

-

Bitcoin5 years ago

Bitcoin5 years agoAnother Exit Scam: NovaChain Shuts Down

-

Exchanges5 years ago

Exchanges5 years agoCrex24 Will Require KYC Verification

-

Bitcoin5 years ago

Bitcoin5 years agoJohn McAfee Has Gone Missing

-

Altcoins5 years ago

Altcoins5 years agoElrond Partners With ChainLink