Security

Hackers Targeted Coinbase Employees

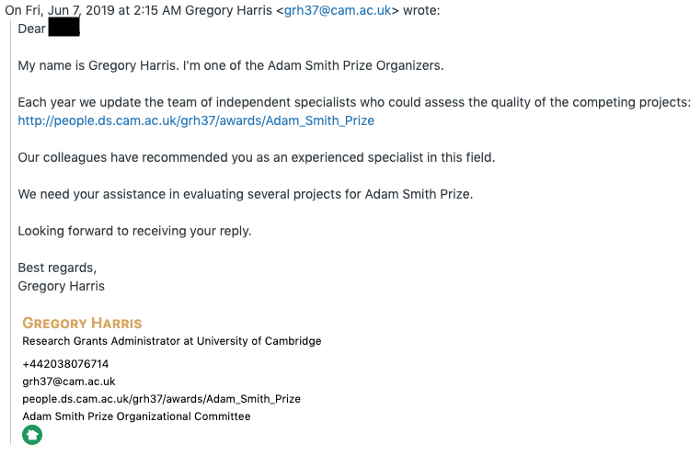

Coinbase revealed that its employees were targeted by sophisticated hack attacks leveraging two Firefox 0-day vulnerabilities, spear phishing, and social engineering.

The attacks started on June 17, where Coinbase’s employees received emails from Gregory Harris, a Research Grants Administrator at the University of Cambridge contained a web link that, when opened in Firefox, would install malware capable of taking over someone’s machine. The attacks were detected and blocked by Coinbase’s security team.

The attackers seems to be highly skilled and experienced in writing exploit codes as they used unpublished Firefox 0-days, they hacked two Cambridge university email accounts, created created a landing page with exploit code at the University of Cambridge official domain and they could bypass Coinbase spam filters.

Coinbase team reached out to Cambridge University to assist in securing their infrastructure and to collect more information about the attacker’s behavior.

Coinbase is a cryptocurrency exchange headquartered in San Francisco, California. Coinbase is considered to be the largest cryptocurrency exchange in USA.

Bitcoin

No Evidence of Hack, Says Bitfinex CTO Amid Ransomware Gang’s Allegations

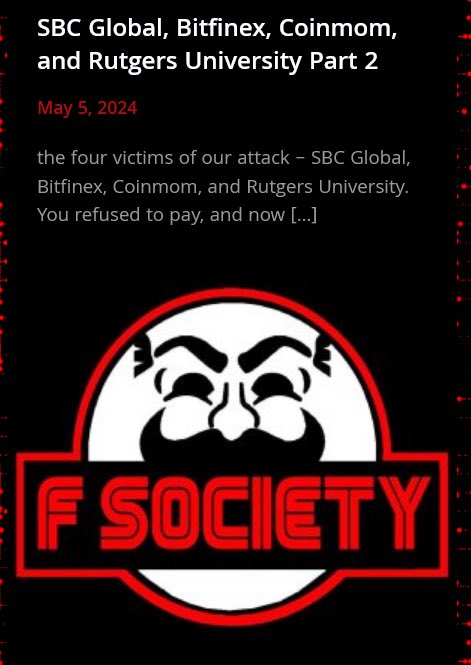

In the world of cybersecurity, claims of data breaches can cause significant concern and speculation. Recently, a ransomware group named FSOCIETY claimed to have successfully hacked several organizations, including the cryptocurrency exchange Bitfinex. However, Bitfinex’s Chief Technology Officer (CTO), Paolo Ardoino, has dismissed these rumors, stating that a thorough analysis of their systems revealed no evidence of a breach.

According to Ardoino, who is also the CEO of Tether, less than 25% of the email addresses allegedly stolen from Bitfinex’s servers match legitimate users. This casts doubt on the validity of FSOCIETY’s claims regarding the supposed hack.

The ransomware group, styled after the fictional hacking group from the TV show “Mr. Robot,” claimed to have breached several victims, including Rutgers University, consulting firm SBC Global, and a cryptocurrency exchange they referred to as “Coinmoma,” which is likely a misspelling of Coinmama.

Ardoino expressed skepticism about the group’s claims, stating that if they had indeed hacked Bitfinex, they would have demanded a ransom through the exchange’s bug bounty program, customer support channels, emails, or social media accounts. However, Bitfinex received no such requests from FSOCIETY.

Furthermore, Ardoino shared a message from a security researcher suggesting that the real motivation behind the alleged hacks might be to promote FSOCIETY’s ransomware tools, which they reportedly sell access to in exchange for a subscription fee and a commission on stolen profits. Ardoino questioned the group’s need to sell their tools for $299 if they had truly hacked a major exchange like Bitfinex.

It’s worth noting that Bitfinex has previously fallen victim to a significant hack in 2016, resulting in the theft of a substantial amount of Bitcoin. Two individuals, including crypto rapper ‘Razzlekhan,’ pleaded guilty to money laundering charges in connection with that incident.

While the claims made by FSOCIETY have yet to be verified by the alleged victims, Bitfinex’s CTO remains firm in his stance that no breach has occurred. As cybersecurity threats continue to evolve, it is crucial for organizations to remain vigilant and take proactive measures to protect their systems and users’ data.

Exchanges

Smart Contract Hacking Costs Ex-Engineer $12M and His Freedom

A former senior security engineer was sentenced to three years in prison for executing sophisticated hacks against two decentralized cryptocurrency exchanges, stealing over $12 million worth of digital assets.

Shakeeb Ahmed, 34, of New York, pleaded guilty to computer fraud charges related to the July 2022 hacks. He exploited vulnerabilities in the smart contracts governing the exchanges to artificially inflate fees and purchase crypto tokens at manipulated prices.

Damian Williams, the U.S. Attorney for the Southern District of New York, announced the sentencing and first-ever conviction for hacking a blockchain smart contract. “No matter how novel or sophisticated the hack, this office is committed to following the money and bringing hackers to justice,” Williams stated.

The Two Crypto Exchange Hacks In the first hack, Ahmed exploited a pricing flaw in an unnamed decentralized exchange. He inserted fake data to generate around $9 million in inflated fees, which he then withdrew as cryptocurrency. Ahmed later agreed to return most of the funds to avoid prosecution.

Weeks later, Ahmed struck again by hacking Nirvana Finance, a decentralized exchange for the ANA token. He used a flash loan to purchase ANA at an artificially low price through a smart contract exploit. Ahmed then immediately sold the ANA back to Nirvana at the higher market rate, netting $3.6 million – virtually all of Nirvana’s funds.

After the attacks, Ahmed searched online for information about the hacks, potential criminal liability, and how to flee the country to avoid charges.

Sophisticated Money Laundering Techniques To cover his tracks, Ahmed employed advanced crypto money laundering methods. These included swapping tokens, “bridging” funds between blockchains, converting to privacy coin Monero, using overseas exchanges, and leveraging “mixers” like Samourai Whirlpool.

In addition to his prison sentence, Ahmed was ordered to forfeit the $12.3 million in stolen cryptocurrency. He must also pay over $5 million in restitution to the victim exchanges.

Altcoins

P2P NFT Trading Platform Faces Breach: Users Urged to Take Immediate Action

NFT Trader, a peer-to-peer (P2P) trading platform, recently experienced a security breach leading to the unauthorized transfer of significant NFT assets. The attacker, identified as 0x90…8fda, successfully made off with 37 Bored Ape Yacht Club (BAYC), 13 Mutant Ape Yacht Club (MAYC), 4 World of Women, and 6 VeeFriends NFTs, collectively valued at 1,080 ETH (approximately $2.4 million). Users are strongly advised to promptly revoke any authorization granted to the platform.

Initial reports, shared by Chinese crypto news reporter Colin Wu on social media, indicate that the pilfered NFTs were sent to the address 0x909F2159780e64143CF08f32dBBF56Ed19478fda (link to tweet). An on-chain message from the address holder, claiming the role of a “scavenger,” refutes allegations of hacking the P2P trading platform. Instead, they assert rescuing the NFTs with the intention of returning them.

Further information reveals that the alleged real hacker’s address is 0x3dc115307c7b79e9ff0afe4c1a0796c22e366a47b47ed2d82194bcd59bb4bd46.

NFT Trader has acknowledged the security incident and disclosed that the attack targeted old smart contracts. In response, the platform is advising users to remove delegations via Revoke.cash from the following addresses:

- 0xc310e760778ecbca4c65b6c559874757a4c4ece0

- 0x13d8faF4A690f5AE52E2D2C52938d1167057B9af

Despite being relatively unknown among NFT traders, NFT Trader’s website identifies its CEO as John Pak, collaborating with co-founders Mattia Migliore and an individual using the pseudonym “Bruckzr” (link to tweet).

On social media, an NFT collector (@dingalingts) has urged traders to “revoke approval to their contract ASAP” for those who have engaged with NFT Trader previously. The stolen digital assets, which exceed $2 million in value, include 37 BAYC, 13 MAYC, 4 World of Women, and 6 VeeFriends.

-

Altcoins4 years ago

Altcoins4 years agoProject Review: Pi Network, a New Scam Project in Town

-

Bitcoin4 years ago

Bitcoin4 years agoBitcoin Worth $1.2M Seized From Arrested Indian Hacker

-

Altcoins5 years ago

Altcoins5 years agoReview: Play Arcade Games Inside ARK Wallet And Win Some Free Cryptocurrency

-

Blockchain5 years ago

Blockchain5 years agoA Full Review: Utopia A New Decentralized P2P Blockchain

-

Bitcoin5 years ago

Bitcoin5 years agoAnother Exit Scam: NovaChain Shuts Down

-

Exchanges5 years ago

Exchanges5 years agoCrex24 Will Require KYC Verification

-

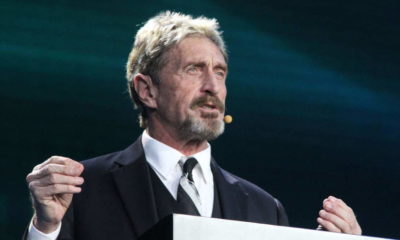

Bitcoin5 years ago

Bitcoin5 years agoJohn McAfee Has Gone Missing

-

Altcoins5 years ago

Altcoins5 years agoElrond Partners With ChainLink